Here is the full address by Mrs. Winifred Akpani, Chairman, Depots and Petroleum Products Marketers Association of Nigeria (DAPPMAN) on how downstream oil subsector is faring in Africa

TOWARDS A SUSTAINABLE DOWNSTREAM SECTOR FUELED BY A LEVEL-PLAYING FIELD AND SEAMLESS COLLABORATION

Being address by Mrs. Winifred Akpani, Chairman, Depots and Petroleum Products Marketers Association of Nigeria (DAPPMAN) at the DAPPMAN Secretariat in Lagos, on November 8, 2022

Over the last year, the African Downstream sector has gone through significant changes. Just as the recoveries from the Covid-19 pandemic were beginning to be felt, the Russia-Ukraine conflict began. Globally, there has also been a push for addressing climate change and achieving net zero by mid-Century. Consequently, the world is reeling from a global energy crisis, which has affected the Downstream sector as well.

DAPPMAN wishes to commend the Federal Government and the regulatory authorities for emerging gains in the sector, especially, following the introduction of the Petroleum Industry Act. There have been important meetings aimed at shaping a sustainable future for the sector. These must continue as the success of the sector in the face of the intervening global energy crisis depends on collaboration and consideration of how operators can shore up capacity on the wings of market-friendly policies and a level-playing field.

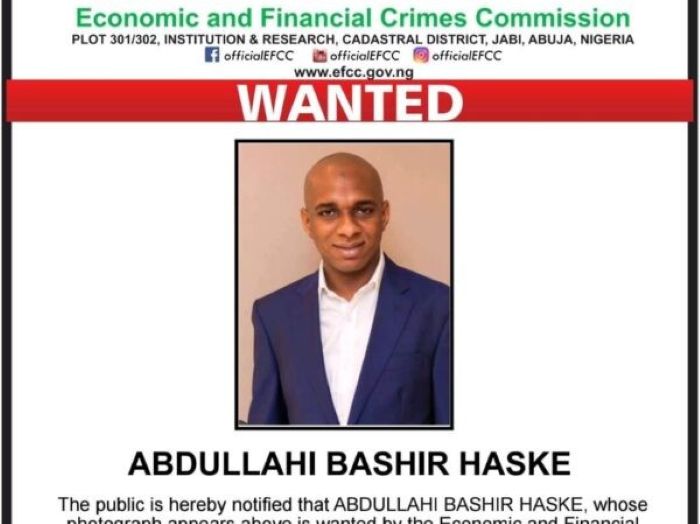

The recent discovery of illegal pipelines that have been siphoning huge volumes of crude undetected for years is indicative of the sophistication of the perpetrators of these coordinated heists in Nigeria’s oil and gas sector and the need for more proactive and intentional ways of repositioning the sector.

As a nation, we will need to ensure we adopt policies and initiatives to combat oil theft effectively and collectively. It is also important for regulators and operators to collaborate much more closely in the areas of sharing intelligence and incorporating modern technologies to address these issues. Digitalization is a good first step towards profitability and sustainability of the industry.

Petroleum Products: Many African countries are struggling with the high prices of petroleum products, including Premium Motor Spirit (PMS, also known as Petrol), Diesel & Jet Fuel. Gas products such as Liquefied Petroleum Gas (LPG), typically used for cooking, are also not excluded from spiraling prices.

One of the major problems comes from the Upstream part of the supply chain as some African Oil Producers have not been maintaining production levels. African countries like Angola and Nigeria, have consistently been unable to meet their OPEC production quota. The dwindling production rates are due to under-maintenance of the production facilities, under-investment, spate of vandalism and sabotage.

The continued high price environment, coupled with forex and inflationary challenges, impact oil products demand in Nigeria as the nation is a net importer of petroleum products.

Generally, the Nigerian market has the NNPC Ltd as primary supplier of products to the market, a situation that has meant limited inflow of products and attendant episodic fuel scarcity.

In the case of liberalised products such as Diesel, Jet A1, and LPG, petroleum marketers continue to struggle with challenges associated with credit lines and access to USD through CBN’s official window.

CITAC (a specialist consulting company for the African downstream energy market) estimates that Sub-Saharan Africa’s oil products demand will amount to 112.3mn mt in 2022. In 2023, CITAC expects to see Sub-Saharan Africa’s oil products demand at 116.5mn mt, up by 3.7% by this time next year. To meet this demand, important and strategic decisions must be made. For us in Nigeria, this will include full deregulation of the sector and a deliberate strategy geared towards creating an enabling environment for all petroleum marketers to add value, alongside the NNPC.

It is a relief to see the conversation around fuel subsidy removal gaining traction in the nation. In Nigeria, numerous reports have indicated how the subsidy on PMS encourages illegal exportation to some neighbouring countries. The price differential has for decades served as a huge incentive for moving PMS across the borders where the product is then sold at a premium. Invariably, the subsidy regime, which was designed to serve the purpose of giving more Nigerians access to PMS has only succeeded in benefitting people involved in underhand activities.

Sundry analyses and research have also shown the huge impact of fuel subsidy payments on the Nigerian economy, to the detriment of critical sectors like health, defence, education and transportation – while the nation keeps recording debts to the tune of trillions of naira.

Albeit late, DAPPMAN considers the declaration by President Muhammadu Buhari that fuel subsidy will end in 2023 as the right decision that will reposition the sector for sustainable growth and development, while freeing up funds to shore up the capacity needed to transform our health, education, defence, and transportation sectors among others.

DAPPMAN also notes that most of the presidential candidates have declared their plans to jettison the fuel subsidy regime. This will ultimately liberaliseand transform the downstream sector with attendant benefits for the economy and quality of life, through the supply and distribution of premium and environmentally friendly petroleum products.

Looking Ahead

As we approach the Yuletide and transition to the election year in 2023, the nation will need the full involvement of all operators to shore up capacityand ensure product availability at excellent service levels. While there might be fears regarding possible scarcity of PMS, DAPPMAN assures Nigerians of its ability and willingness to work assiduously to ramp up supply as the government addresses the challenges of FX availability in the sector.

DAPPMAN believes the current situation in the sector that gives only the NNPC the role of sole importer of PMS is not sustainable, considering the huge consumption of the product.

Accessing USD for transactions has been an insurmountable hurdle for petroleum marketers. The difference between Central Bank of Nigeria (CBN) exchange rate and the Parallel market exchange rate continues to get wider by the day.

Currently, the CBN Exchange Rate stands at about 450 Naira to one Dollar, while the Parallel Exchange Rate is about 880 Naira to one Dollar, and the only direction from this point appears to be northwards.

Here’s an apt picture of how the FX conundrum affects petroleum marketers. For example, to charter a vessel to convey 20,000 MT of PMS withun Nigeria for 10 days, freight charges are denominated in USD, that comes to about N220 million at official FX rate of N440 and a whoopingN440 million for petroleum marketers who have to source FX from the parallel market at N880. This implies an additional cost of N11 per litre for this transaction due to the FX official/parallel market differential.

For this same transaction, Jetty fees, again charged in USD, comes to N15.4million at offical FX rates and N30.8 million for petroleum marketers who source from the parallel market.

In the same vein, Jetty Berth is charged in USD and comes to N2.2m at official FX rate and N4.4 million at parallel market rate.

Then there are Port dues (NPA and NIMASA), which are charged in USD, which come to official N71.51 million at official FX rate and N142.796 million for marketers who source FX from the parallel market.

This is quite burdensome and has made operational expenses and procurement increasingly difficult for DAPPMAN members. Amid this inclement situation, petroleum marketers still must compete, rather unfavorably with the NNPC which has access to FX at the CBN exchange ratealso has the added advantage of getting products through swap arrangements.

The NNPC which historically served as the supplier of last resort, is now the major oil downstream company in Nigeria with the acquisition of OVH and has full access to USD at CBN’s official rates.

Without a level-playing field, especially one that guarantees access to USD for all marketers at official rates, marketers’ ability to import products is continually and severely hampered, as a significant portion of their operations and critical operational and capital expenses are denominated in USD. Full availability of products, particularly PMS will experience a marked boost when access is granted to FX at official rates for all operators and subsides removed completely.

Petroleum marketers also must contend with sourcing funds from the parallel market to pay for fees and levies that are denominated in USD. These include costs such as vessel hiring charges in FOREX as stated aboveto the Nigerian Ports Authority (NPA) and Nigerian Maritime Administration and Safety Agency (NIMASA). There are also several unauthorised operational levies/fees incurred in the process of distribution of imported products which the regulators need to address. Sourcing these funds fromthe parallel market and paying unauthorised levies have left petroleum marketers in dire straits, making it virtually impossible for fresh investments that can shore up operations and service experience.

DAPPMAN hereby calls on the government to establish a level playing field in the sector by giving petroleum marketers access to FX at the CBN exchange rate for their operations. This is a passionate appeal to the government as we can confidently state that accessing FX through the CBN window will significantly enhance capacity and facilitate seamless supply of PMS as we head into the Yuletide and ultimately, birth a regime of sustainability in terms of storage, distribution, and supply across the nation.

DAPPMAN members have always demonstrated the capacity to serve exceptionally despite stacked odds as evidenced by our commitment to Nigeria. Our operations continue to power lives, businesses, and the economy. Getting access to FX from the official window and paying for levies/fees in NGN would markedly transform service levels and spur product availability to new heights across the nation. DAPPMAN is hopeful that these requests will be considered and ultimately granted, given the commitment of the government and the Nigerian Midstream and Downstream Regulatory Authority to shaping a prosperous future for the sector and by extension, our great nation.

This will also give downstream operators the opportunity to invest more in human capital development, infrastructure upgrades, and meet globally prescribed standards in quality, health, safety, security, and the environment.

Ultimately, this would lead to more employment and spur economic growth and development within the country, while also facilitating a sure march towards sustainability in the sector.

DAPPMAN would like to express its profound gratitude to all Nigerians for their patience and support to the industry. We will continuously strive to provide the best service to fuel accelerated economic growth across the nation.

Finally, we assure the nation that we will continue to work hard to ensure all Nigerians enjoy a merry Christmas and a happy year 2023.

Thank you for your attention